Rethinking Credit Card Merchant Fees

Today, we see the majority of firms reluctantly accepting credit cards from some clients to pay for their accounting services. A relatively small number of firms advertise this option and most only bring it up either when a client specifically asks to use their card or when the firm is trying to collect on a long outstanding, questionable receivable.

Since credit card merchant fees are usually in the 3% to 7% range, many firms have set artificial limits of $2,000 to $2,500, which targets credit card usage towards smaller invoices, such as 1040-only clients. Most firms discourage accepting credit cards above their artificial limit as fees can be substantial. For example, a traditionally good client that has an annual $30,000 audit fee that they normally would pay by check, would cause the firm to give up approximately $1,200 in merchant fees. Some firms look at this as a cost of doing business and include this in their administrative rates, but most are in a quandary of how they should handle this, which interestingly has changed.

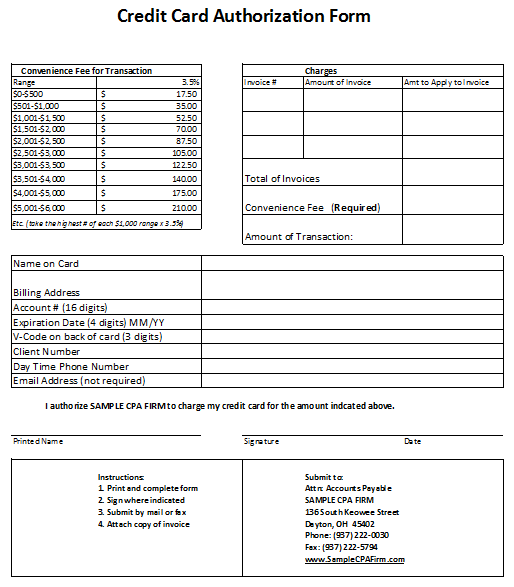

At the end of last year, the US District Court in New York had a preliminary settlement with VISA and MasterCard allowing merchants to pass on credit card charges to clients beginning January 27, 2013, which they referred to as a “checkout fee.” The proposed rules are very specific in limiting how the charge should appear and are limited to 4% (taking into consideration that ten states already have surcharging restrictions: CA, CO, CT, FL, KS, ME, MA, NY, OK, TX).

While many firm partners state they don’t want to appear to be “nickel and diming” clients, we spoke with one firm (that requested not to be identified) that has found an effective way to overcoming this obstacle when giving the client the option of paying by credit card and recouping a portion of the merchant fee. Our firm representative shared they are very careful to explain the convenience fee at the beginning of the discussion and let the client know specifically what that amount will be based on the amount that is being paid. The client must complete the Credit Card Authorization Form which lists the convenience fee separately and is one of the requirements of the new regulations. This firm chose to utilize a 3.5% fee as it was an average of what was being charged and did not accept other credit cards, some of which had significantly higher fees. Below is the form they are using to streamline the process.

If your firm is still debating whether to accept credit cards, you may want to share the recent changes with your partners and look into the specific rules and regulations with your merchant provider in your state to see if you should be rethinking accepting credit cards for all your clients.

About the Author

Roman H. Kepczyk, CPA.CITP, CGMA, and Lean Six Sigma Black Belt is Director of Consulting for Xcentric, LLC and works exclusively with accounting firms to optimize their IT infrastructure and internal production workflows within their tax, audit, client services and administrative areas. Roman also partners with firms considering mergers in evaluating the technology and applications of the two entities to identify the optimum composite firm moving ahead. Roman can be reached at roman@xcentric.com and 678-495-0508.

Roman H. Kepczyk, CPA.CITP, CGMA, and Lean Six Sigma Black Belt is Director of Consulting for Xcentric, LLC and works exclusively with accounting firms to optimize their IT infrastructure and internal production workflows within their tax, audit, client services and administrative areas. Roman also partners with firms considering mergers in evaluating the technology and applications of the two entities to identify the optimum composite firm moving ahead. Roman can be reached at roman@xcentric.com and 678-495-0508.