Diversity, Equity and Inclusion in Accounting: What Is Ours to Do?

The murder of George Floyd on May 25, 2020 heightened many Americans’ awareness of the deeply rooted, systemic racism that has existed in our country since inception and continues to evolve over the years. As a profession that has been historically dominated by white people – white men, in particular, considering even today, women represent only 23% of partners in CPA firms according to the AICPA – we still have a long road ahead of us to create a profession that is more diverse, equitable and inclusive for all.

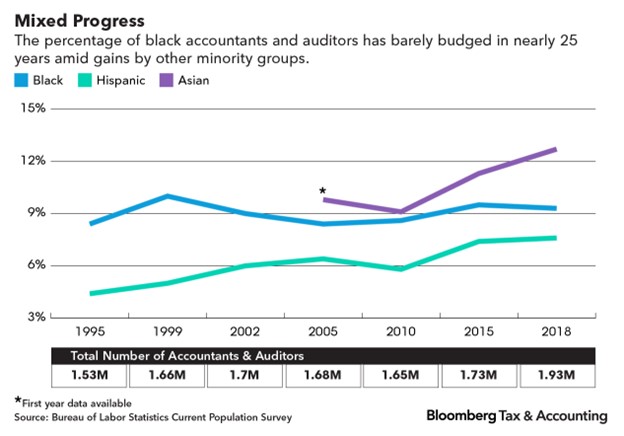

According to the National Association of Black Accountants (NABA), less than 1% of CPAs in the US are Black (compared to 13% of all US residents). This figure has remained fairly stagnant over the past two decades. (Source: Bloomberg Tax, July 2019)

Accounting firm leaders who want to ensure the future of the accounting profession includes all of us are revisiting and investing even more of their time, energy and resources in diversity, equity and inclusion (“DEI”) efforts.

To support you and your organization with your own DEI efforts, we are sharing some of the challenges and insights from a recent discussion with our I2L Innovators community.

Firms are grappling with the following challenges:

- Many (perhaps all) feel like they are not where they need to be on DEI. Firms who felt they were relatively progressive several months ago quickly realized they are not. They have a heightened awareness of how much more work there is to do.

- Employees and clients are asking firm leadership specific questions about what is being done to accelerate DEI at the firm. At times, this can feel overwhelming, as many leaders are still determining their path forward. At the same time, these requests provide a powerful level of accountability to make meaningful, sustainable change.

- Leaders are struggling with their messaging regarding tragic events that continue to impact the Black community. They don’t want to remain silent. They do not want to be performative. They do want to ensure their message is authentic and backed by a commitment to change.

- Leaders are revisiting what they stand for and who they are as a firm. They are reconnecting with, and even reconsidering, their core values.

As daunting as these challenges are, the group uncovered several powerful insights that could support you and your organization on your DEI journey:

- Rather than creating a separate initiative or program, embed DEI within all aspects of the organization, as a foundational tenet of the firm’s culture, values and leadership. Consider DEI in all aspects of firm business, including recruiting, hiring, evaluations, promotions, education/training, leadership positions, leadership development and coaching programs, firm communications and social events.

- Create space for authentic, uncomfortable conversations. Change requires vulnerability and transparency. It takes time to create a more inclusive culture and build people’s tolerance for differing viewpoints. Affinity groups can help people work through discomfort.

- Embrace a growth mindset, otherwise the fear of “getting it wrong” can paralyze progress. To make meaningful change, you must take risks, make mistakes and learn from them. (This can be especially hard for accountants who want to “get things right.”)

- Commit for the long term. DEI is not a “trend” or “hot topic.” Systemic racism has been around for hundreds of years. You cannot change things overnight. You must take consistent, substantive actions over time.

- Acknowledge that accountants are not experts when it comes to DEI, and hire experts as needed (e.g., DEI consultants) to bridge knowledge gaps. As a leader, continue the lifelong journey of self-education in anti-racism, and share what you learn with others.

- For those starting the DEI journey, consider the following ideas to start:

- Take stock of where you are today. What is your firm’s demographic make-up? What policies and programs do you already have in place?

- Create space for safe conversations. Focus on listening to your people, particularly those from marginalized and underrepresented groups. What are they asking for? What do they need from you?

- Provide training/development on the growth mindset (to create a culture where mistakes are recognized as valuable and necessary for growth) and/or implicit bias.

As daunting as the DEI challenges are for the CPA profession, witnessing the discussion within this group left us feeling renewed and inspired. Yes, there is a lot of work ahead to create a truly diverse, equitable and inclusive profession. Yes, we have a lot to learn. Yes, we will make mistakes along the way. But, through the power of collaboration, we can create collective change in the profession.

About the Author

Sarah Elliott, CPA, PCC is the co-founder and principal of Intend2Lead, a leadership development company that coaches CPAs to access the Dimension of Possibility through leadership coaching, group learning and consulting with organizations to create coaching cultures.